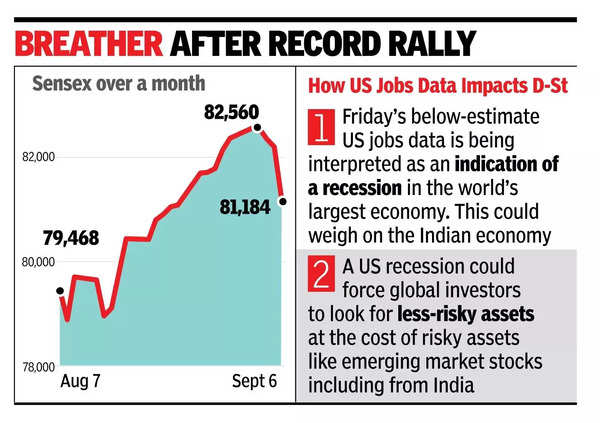

Investor sentiment on the street was also hit by defense minister Rajnath Singh’s caution to forces to be ready for any unexpected events, Market Players said.The day’s session left investors poorer by Rs 5.5 lakh crore with BSE’s market capitalization now at Rs 473 lakh crore. With the markets at record high, investors are also looking for opportunities to book profits, they said.

According to Joseph Thomas of Emkay Wealth Management, overheating segments have seen some profit-booking and this may be an indicator that earnings would incrementally dictate price movements. “From a global perspective the focus is now on the economic data coming from the US to gauge the direction and the quantum of Fed rate movement in the upcoming FOMC meeting.”

For the last two days, investors globally awaited a crucial US jobs report due Friday evening that would likely decide if the Fed would cut rates. And if they decide to cut rates again after more than five years, what could be the quantum of the cut. After the Indian markets closed, the US announced a set of labor data that made investors jittery about the state of the American economy. As a result, in mid-session in the US market, all the three major indices – S&, Dow and Nasdaq – were deep in the red.

In Friday’s session in the domestic market, selling was across the board with every sectoral index on the BSE closing in the red but at varying degrees. The telecom index lost the most, followed by oil & gas and energy.

During Friday’s session there were rumors in the market that some foreign funds that were unwilling to meet Sebi’s new rule of parting with disclosure of ultimate beneficial owners of their funds, were selling aggressively. End-of-the-session data, however, showed a net outflow of Rs 621 crore that did not justify the rumours.

During the day, Vodafone Idea’s stock on the BSE tanked 11.5% on the back of a Goldman Sachs report that estimated it could fall by as much as 83% to Rs 2.5. On Friday, the stock closed at Rs 13.4.