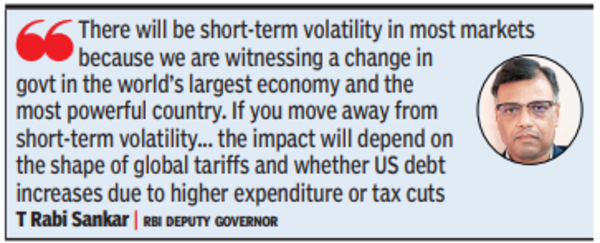

MUMBAI: RBI deputy governor T Rabi Sankar said Donald Trump’s election as US President would lead to volatility in the financial markets, but that it would be short-lived given that significant funds are expected to flow in due to India’s inclusion in global index funds.

“There will be short-term volatility in most markets because we are witnessing a change in govt in the world’s largest economy and the most powerful country. If you move away from short-term volatility arising from the gain in the dollar index, US stocks , or US interest rates, the impact will depend on the shape of global tariffs and whether US debt increases due to higher expenditure or tax cuts,” Sankar said. The deputy governor was speaking at a fireside chat at an event organized by the Business Standard.

“From India’s standpoint, as far as the exchange rate impact is concerned, we are well equipped to tackle any excessive volatility. An increase in US debt issuance could raise interest rates, which would affect us as well. But with capital flows following India’s inclusion in global bond indices – half of it has come and the other half is expected in the next few months – India is likely to be included in the FTSE and Bloomberg indices. able to manage even interest rate volatility,” he said.

On the issue of the European markets regulator’s demand to oversee Indian clearing houses, Sankar said the European Securities and Markets Authority was being “extra-jurisdictional” in its wish to audit the Clearing Corporation of India (CCIL).