NEW DELHI: Japanese companies Honda and Nissan’s plans to merge operations in view of tough business challenges may not only impact their global operations but may prove to be a tough road to navigate in India, especially in view of their independent large production set-ups and presence of Renault of France as an alliance partner with Nissan.

Moreover, the near negligible operations of Mitsubishi in India – another constituent in the Honda-Nissan proposed merger – makes the whole plan even more confusing here. Mitsubishi was being sold in India in partnership with the CK Birla group, though the latter has now tied up with the French PSA group for making Citroën cars.

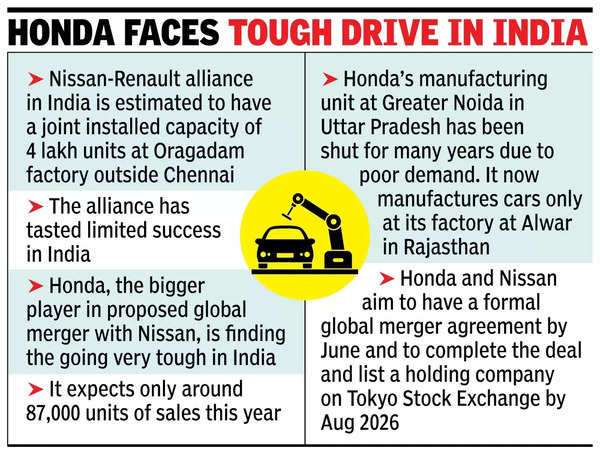

Consider the complexities of Nissan and Honda’s businesses in India: Nissan, which once had a joint venture with Ashok Leyland (called off around 2016), operates in India through a manufacturing joint venture with its global alliance partner Renault. While the two companies have had their own share of differences globally, the alliance in India, estimated to have a joint installed capacity of 4 lakh units at Oragadam factory outside Chennai, has been struggling on sales front.

Both Nissan and Renault have scored limited success in India and have failed to capitalize on any positive leads. Nissan particularly tried to balance operations by having an export-oriented model, but even this has proven to be tough.

It is not yet clear on what will be the fate of the Chennai factory if the Nissan-Honda global deal does not have any participation from Renault. Also, on what terms would the Nissan cars or for that matter Renault be made at the Chennai factory is a question, which will need answers as things move forward.

When asked about Renault, Nissan president and CEO Uchida Makoto, said, “Synergies with Renault is another possibility we are exploring. With this MoU between Honda and Nissan, we will continue working with Renault based on projects that generate synergies. Irrespective of today’s announcement. , we will continue to have a constructive discussion.”

Honda, the bigger player in this proposed global merger, is finding the going very tough in India. While the company was once seen as a strong player, it has failed to live up to its reputation and has steadily lost market share to traditional challengers, such as Maruti Suzuki, Hyundai, Toyota, and even local brands Mahindra & Mahindra and Tata Motors.

Honda in India expects near-negligible growth in sales this year (around 87,000 units). The company’s manufacturing unit at Greater Noida has been shut for many years now in view of poor demand. It now manufactures cars only at its factory at Alwar in Rajasthan. Honda is widely banking on entry sedan Amaze and Elevate SUV to survive. And as rivals launch electrics, Honda will get its first EV only around 2026.

At their global conference in Tokyo, Honda and Nissan, which are facing tough competition from players like BYD and Tesla, said they will attempt to unify their operations under a joint holding company. They aim to complete the deal by Aug 2026.