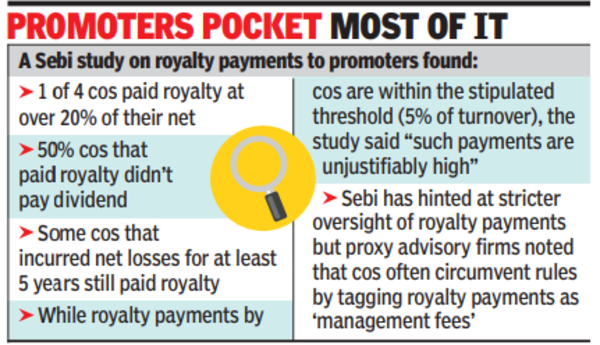

MUMBAI: Some listed Indian companies make royalty paymentsmostly to promoters, at the cost of shareholders, a study by markets regulator Sebi showed. The study found that one out of four companies paid royalty at more than 20% of their net profit while some paid royalty, but didn’t pay dividend to shareholders.

There were also instances where some companies paid royalty even when they didn’t make any profits, and in some cases the rate of growth of royalty payment over the years was much higher than the rise in revenue and profit.

The study was conducted over a 10-year period (FY14 to FY23), using disclosures made by 233 companies. There were 1,538 instances of royalty payments by these entities over this 10-year period.

Sebi regulations require that if any listed company pays more than 5% of its consolidated annual turnover as royalty to ‘related parties’ or RPs, that should be put to minority shareholders to vote on. The payment could be made only if such shareholders agree. The rule has been effective since FY20.

The study showed that these companies together paid about Rs 75,000 crore through royalty to RPs, meaning promoters in most cases. Of the total, in FY23 alone, royalty payment aggregated nearly Rs 10,800 crore.

In “one out of two times, listed companies that paid royalty, did not pay dividend, or paid more royalty to RPs than dividend paid to non-RP shareholders,” the report noted. “In one out of three such instances, listed companies paid royalty exceeding 20% of their net profits.” Sebi’s analysis also found that 10 companies had incurred net losses at least for five years but paid royalty amounting to Rs 228 crore to their RPs.