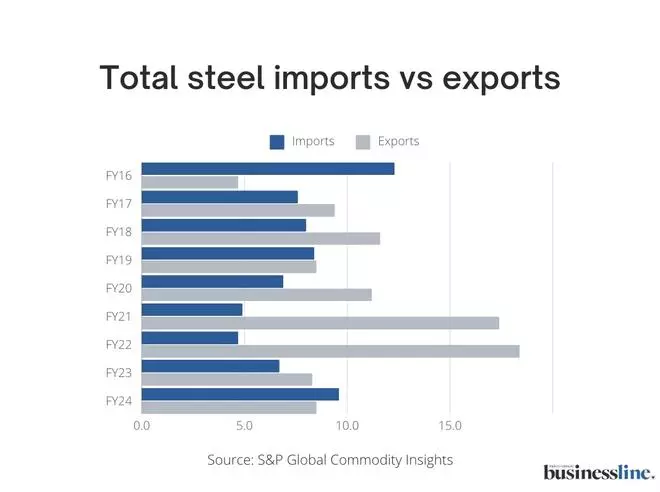

India’s steel trade dynamics underwent significant changes in FY24. After being a net exporter until 2017, India became a net importer, resulting in a trade deficit of 1.1 million tonnes (MT).

In FY24, the country’s finished steel imports surged by 38 per cent year-on-year, reaching 8.3 MT.

This surge led companies like ArcelorMittal Nippon Steel (AM/NS) and JSW Steel Limited to initiate an anti-dumping probe, claiming that the influx of inexpensive HRC (hot-rolled coils) steel from Vietnam is negatively impacting the local prices.

However, the data tell us a different story: the real challenge actually comes from China.

HRC steel makes up 62 per cent of the total import volume, with a notable 117 per cent increase. This steel type serves as a fundamental raw material for many downstream products, making it essential in industries such as automotive, construction, pipes and tubes, shipbuilding, machinery and appliances.

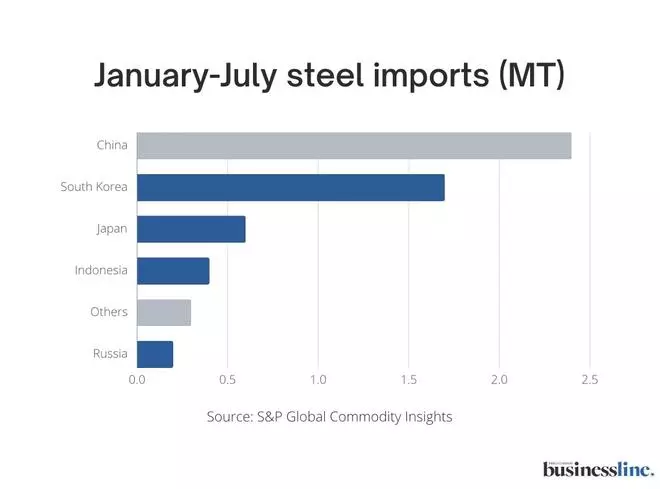

According to the S&P Global Commodity Insights report, China dominated India’s steel imports in FY24, accounting for 43 per cent of the total, with 2.7 MT, and emerging as the largest exporter to India. While Vietnam, despite seeing a significant 130 per cent year-on-year increase in steel exports to India, accounted for only about 20 per cent of the country’s total steel imports.

“It’s difficult to curb Vietnam imports since India also exported significant quantities to Vietnam in the first half,” said an India-based trader, according to Commodity Insights report.

Interestingly, Vietnam, despite being a major steel exporter itself, was also a significant destination for Chinese steel exports.

“Current bids from India are too low; we can’t command any premium compared to other regions, but it’s better than nothing,” a Chinese exporter said, according to the report.

According to Commodity Insights, the price of Chinese steel shipments ranged from $540 to $545 per metric ton for deliveries across India, whereas Vietnamese steel shipments arriving in September cost $560 per metric ton for deliveries to Mumbai and $553 per metric ton for deliveries to Chennai, indicating that Chinese steel imports were generally cheaper.

According to a Crisil report, the downturn in China’s real estate sector, one of the key drivers of domestic steel demand, has had a significant ripple effect on the global steel market. As construction projects slowed and property sales declined, the need for steel within China decreased sharply. This drop in domestic demand forced Chinese steel producers, who are accustomed to operating at high capacities, to find alternative markets to offload their surplus production.

In response, these producers ramped up their steel exports, targeting international markets where they could sell their excess steel. India emerged as a major destination for this surplus steel due to its growing demand driven by infrastructure projects and industrial development.

On the export side, India saw a notable rise in FY24, with finished steel exports growing by 11.5 per cent year-on-year to about 7.5 MT.

Beyond the challenges posed by low-cost steel imports from China and Vietnam, Japan has become a strong competitor in India’s steel market, driven by recent macroeconomic shifts.

Amidst the complex landscape of global steel trade, where imports from China and Vietnam have already strained India’s domestic market, another key player has emerged—Japan.

A report by businessline’s The research bureau discussed the recent fluctuations in the Japanese yen, triggered by the Bank of Japan’s decision to raise interest rates to 0.25 per cent on July 31, which have caused ripples across global financial markets.

The yen’s sharp depreciation, driven by the unwinding of the massive yen carry trade—where investors had borrowed cheaply in yen to invest in higher-yielding assets—led to a sell-off in global equities and a significant drop in the USDJPY currency pair. As the yield differential between US and Japanese 10-year bonds fluctuates, with the potential for further US Federal Reserve rate cuts in September, this could lead to even more volatility in currency markets, the report stated.

For India’s steel industry, the weakening yen makes Japanese steel exports more competitively priced, adding pressure to an already strained market facing competition from low-cost imports from China and Vietnam. With Japanese steel now available at lower prices, Indian steel producers may struggle to maintain market share domestically, highlighting how global monetary policies and currency movements can directly impact trade dynamics.

However, despite these challenges, the Indian steel industry is finding strength in its domestic market, as the robust demand within the country itself is providing a vital cushion for the industry. A 13.6 per cent growth in steel consumption occurred within the country, reflecting an increase in the demand for steel driven by ongoing infrastructure projects and industrial development.

Despite a dip in exports during the first half, the second half witnessed a significant rebound, with a 37 per cent year-on-year increase in the final quarter. This surge was fueled by strong demand from the European Union, which emerged as India’s largest export market, reflecting a shift in trade dynamics amid challenging global market conditions.

This growth highlights the resilience of India’s domestic steel market despite external challenges like increased imports and global market fluctuations.

The global steel market, however, remains volatile, with China’s excess production and aggressive pricing affecting trade flows worldwide. Countries like Brazil and the US have imposed tariffs on Chinese steel and other products, while Europe has introduced temporary tariffs on Chinese electric vehicles. These measures reflect the broader impact of China’s industrial policies on global markets, including India’s steel sector.

The world’s largest steel producer recently sounded the alarm over the ongoing crisis in the country, warning of an industry downturn potentially more severe than those in 2008 and 2015. Hu Wangming, Chairman of China’s Baowu Steel Group, described the situation at the company’s biannual meeting. as a “harsh winter” that could become even longer, colder, and more challenging, according to a Bloomberg report.

Interestingly, India is also under scrutiny by the Malaysian government for potentially engaging in dumping practices in Malaysia. The Malaysian Trade Ministry is investigating claims that flat-rolled iron or non-alloy steel products from India are being sold in Malaysia at prices below domestic levels, which is alleged to be harming the local steel industry.

If the investigation concludes that dumping is occurring, Malaysia might impose anti-dumping duties on these imports, which could affect India’s steel export dynamics and further complicate trade relations in the region.

India’s trade relationships with different countries can lead to varying perspectives on pricing and dumping. While India may have concerns about unfair pricing from Vietnam, other countries like Malaysia might also perceive that Indian steel is being sold below market value in their own markets.